IN THE Texas House Of Representatives Ways and Means Committee

BRIEF OF MITCHELL VEXLER AS AMICUS CURIAE SUPPORTING PROPERTY OWNERS ACROSS TEXAS AND THE UNITED STATES OF AMERICA

Bill to Repeal Real Estate Tax in favor of a UNIFORM STATES SALES TAX

A Presentation to President Trump and Elon Musk

02/17/2025

This is the short version of the Amicus created for ZeroHedge. For the full print version of the Amicus Brief Supporting Property Owners and School Districts and Accounting Fraud, both of which are being delivered by hand to President Trump click here and here.

Introduction of Argument

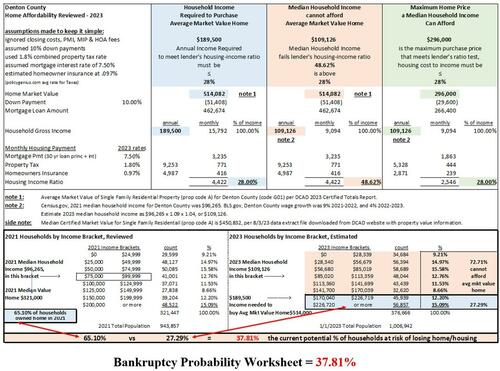

The Home Affordability and Probability of Bankruptcy graphic below shows Taxation of Unrealized Gains, which is a violation of the 16th Amendment to the U.S. Constitution. Market Value is the mechanism in Texas and most States in the Union, from which the Assessed Value is created.

Under current Texas Law you can protest your Market Value but not the Assessed Value. If the Market Value is fraudulent, then so is the Assessed Value.

Comparing Median Household Income and Expenses – All that matters is the Median Household Income

How Much Rent Can I afford? = Median Household Income X .30%.

How Much Debt to Income for a House is standard = 28%

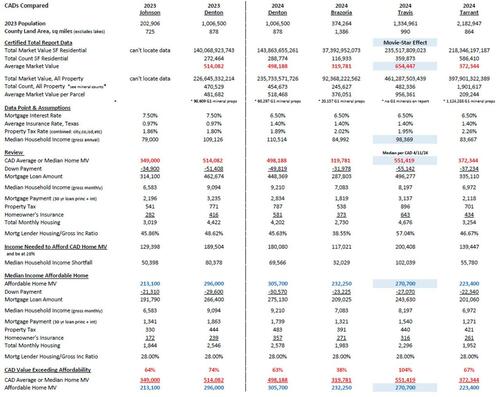

The Bankruptcy Probability Worksheet establishes the following which can be adjusted for any County in the United States:

1. Denton County Median Household Income is $109,126.00

2. Based on a 28% DTI a $109,126.00 income can afford a $296,000 home

3. Denton Central Appraisal District has stated (fraudulently) that the Median Home Market Value is $514,000.

4. To afford a $514,000 home utilizing the DTI of 28% the Median Household Income would need to be $189,500 which is 57% greater than the $109,126 Median Household Income.

5. Home affordability is roughly 74% less than the assessed “market value” proving the fraud because the vast majority of Denton County Citizens do not earn $189,500.

6. The fraud is created by ignoring USPAP (Uniform Standards of Professional Appraisal Practice), Texas Property Tax Code, Texas Constitution and U.S Constitution.

THE CURRENT POTENTIAL % OF HOUSEHOLDS AT RISK OF LOSING THEIR HOME AS A DIRECT IRREFUTABLE RESULT OF THE FRAUD IS 37.81% as seen in the Bankruptcy Probability Worksheet below:

Specifically, what you see is the cumulative compounding fraud on the public via Market Value as solely determined by Denton Central Appraisal District (CAD) and applicable to any CAD in all 3,143 Counties across the United States, between 2021 and 2023, the net result for 2023 is that 72% of homeowners cannot afford the average market value of what DCAD claims is a $514,000 home. 37% of all households are at risk of losing their home. The same mathematical formulas apply across the State of Texas and the United States of America.

You would logically then ask, how could that happen?

Argument

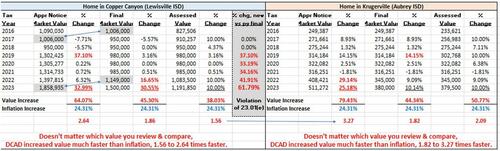

This graphic shows 2 different single-family residences in 2 different municipalities and then looks at the change in appraisal notice market value, final market value and assessed value for the years 2016-2023 and then looks at the inflation, as stated by the U.S. Treasury, during those years.

You will see that regardless of which value percentage compared, being Notice Value, Final Market Value, or Assessed value, DCAD through its corrupt database and co-conspirators increased the values 156% to 327% faster than inflation. The same mathematical formulas apply across the State of Texas and the United States of America.

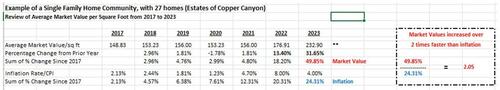

An entire community in Copper Canyon Texas where the values increased 205% faster than inflation.

In Law under USPAP, and The Texas Property Tax Code, what “clear and convincing” evidence exists for a home to go up from $1,149,000 market value to $1,858,935 initial notice value, which is 62% higher than the prior year? The answer is none and this is just a snippet of the corruption of the database and those people deploying made up values (Taxation of Unrealized Gains / Market Value) against the real estate taxpayers. It also proves that DCAD, JCAD, HCAD etc. are incapable, by intent, of obtaining an Initial Notice of Market Value, which is a violation of USPAP, Texas Property Tax Code and the Texas Constitution and The Constitution of the United States of America. The law does not say “lets just make the values up to satisfy a pre-determined budget created by a Taxing Entity (i.e. school district)

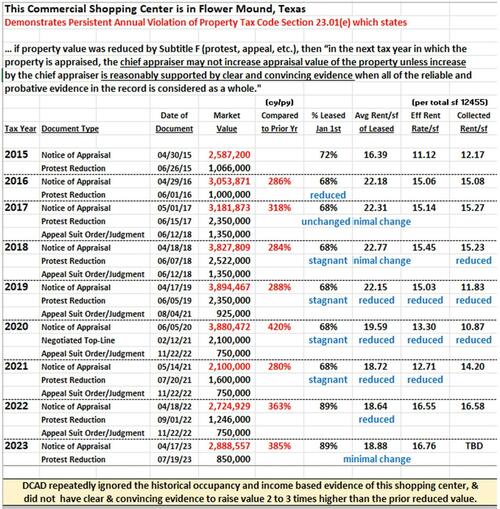

Change in Market Value – Year over year in RED as high as 420%

The change in market value for this commercial property is equivalent to an 8 standard deviation move, when the norm under USPAP is .5 STDEV or + or – 5% to 10%. The odds of an 8 STDEV is 1 in 390,000,000,000 yet there are only approximately 511,000 tax accounts in Denton County. The same mathematical formulas apply across the State of Texas and the United States of America.

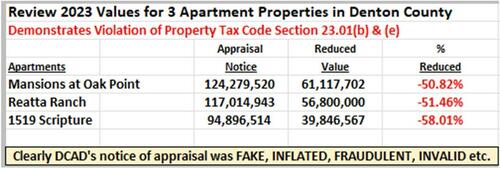

Analysis of three Apartment Properties in Denton County.

DCAD created class codes, beyond the purview of the public, without accuracy or uniformity in its application and in violation of USPAP and Mass Appraisal Standards and thus in violation of the Law.

This graphic shows DCAD’s (an most CADs across the U.S.) failings under the Mass Appraisal Standards:

-

Did DCAD factor in wage growth? No

-

Did DCAD factor in cost of mortgage rates? No

-

Did DCAD look at wage adjusted mortgage payments? No

-

Did DCAD study mortgage application volume? No

-

Did DCAD look at Consumer Price Inflation, month over month % change ? No

-

Did DCAD use proper comparisons as required under USPAP and Law? No

-

Did DCAD conform to USPAP? No

-

Did DCAD examine SF rental income as a method to value SF homes? No

-

Did DCAD study standard deviation of price as a method to value property? No

-

Does DCAD have a system of checks and balance to prohibit corrupt data? No

-

Did DCAD use Standard Deviation to determine the expected move of price? No

-

Did the DCAD Board hire a Chief Appraiser capable of doing the job? No

-

Did the County Tax Assessor Collector knowingly accept corrupt data from DCAD? YES

-

DID DCAD BREAK THE LAW, UPSAP, TEXAS CONSTITUTION, & US CONSTITUTION? YES

-

Did CADs across Texas follow the same non-enforcement of Appraisal Laws as DCAD? YES

In the mass appraisal process, DCAD has failed to consider “all available evidence” and “supply and demand” factors that affect property value.

The exact same method of criminality exists in the majority of CADs across the United States.

The net result of the root causes as outlined above is fraud on a mass scale.

2023 Notice Values in Denton County were over $30 Billion higher than 2022, 20+% higher. DCAD brazenly & recklessly increased values of properties for years, unchecked & without accountability.

Result and effect of their deception & overvaluation in violation of The Texas Constitution in “affordability” analysis.

-

72% of Denton County homeowners cannot afford the average market value of a home.

-

With average market value at $514,082, only 27.29% can.

-

In 2021, 65.10% of households owned a home.

-

In 2023, 37.81% of households are at risk of losing their home (65.10%-27.29%).

-

Households need annual gross income of $189,500 to afford a $514,082 home.

-

With 2023 median household incomes of $109,126 the lender’s housing-income ratio (48%>28%).

-

2023 median income household can only afford a home valued at $296,000

-

72.72% of Denton County homeowners would fail loan approval on $551,082 avg mkt home value.

-

Certified average home values of $514,082 are overvalued by 42% based on affordability. ($514,028 – $296,000 = $218,082. $218,082 / $514,082 = 42%)

-

Average home value in this dollar range ($514,082) are obviously being valued as if NEW.

-

DCAD is using new homes (bad comparisons) to value existing homes.

-

New construction homes should not be used in comparison to older homes.

The summary of the above is:

A.) There is no clear and convincing evidence to justify 20% increases year over year yet alone 420%. Thus, an irrefutable violation of every appraisal method, requirement, and law ever written.

B.) Based on the 140-property sample, what clear and convincing evidence exists to increase commercial property values in bulk by 80% year over year when the cash flows are generally flat? The answer is none, meaning that the initial notice of values is determined by hand, outside the confines of USPAP and the Texas Property Tax Code and the Texas Constitution.

C.) What was the purpose to go from 6 class codes to 28 class codes, when there are no audits of data entry? DCAD thinks, let’s just make it up…nobody will figure it out. “We are DCAD and the public has to trust us”. The best descriptive words to describe this creation of categories is a scam, sham, and con and it gets worse in that even after the creation of these categories, DCAD simply increases the values to meet the pre-determined budgets of the Taxing Entities, all of which ends in a violation of the Texas Constitution.

D.) These class codes do not exist in many other Central Appraisal Districts and there is no uniformity of application.

It is the combination of the above facts created by government overreach and constitutional violations which are demonstrated in the graphics that define government creep, but the mathematical ramifications of violating the very existence of the Laws for the purpose of funding pre-determined budgets of the Taxing Entities (which in itself violates USPAP), shows the level of ignorance of the Central Appraisal Districts and lack of care or understanding for the very people and corporations that generate the revenue to begin with. What you see in the above graphics in Denton County alone is that over 100,000 homeowners today are severely impacted by what DCAD and its co-conspirators have done, which is irrefutably illegal, and criminal and this is occurring across the United States.

You can now see exactly how fraud is perpetrated by the intentional misapplication of Market Value (Taxation of Unrealized Gains). We cannot stress enough the economic damage that will occur across the State of Texas to homeowners, commercial property owners and businesses, if this real estate tax is not repealed in favor of a Uniform States Sales Tax. We have the math that ties to the laws to show how bad this will be, and it shows that the risk greatly outweighs the rewards of owning real estate and will cause a dramatic domino effect of bankruptcies not just of homeowners and income property owners but to the mortgage holders, bond investors, which are pensions and 401Ks. Not repealing the real estate tax will have the effect of destroying the very fabric of everyday American life in that owning a home will be an impossibility for many people who strive to be owners and destroy any reason to own commercial property.

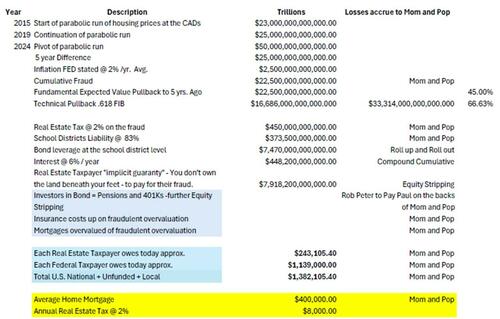

$22.5 Trillion in 5 years of fraudulent overvaluation, resulting in $450 Billion of fraudulent over taxation of Mom and Pop:

Parabolic home prices up 100% in 5 years create losses which accrue to the Property Owners (Mom and Pop). $21.25 Trillion in fraudulent overvaluation led to $450,000,000,000 in over taxation in 2024 alone.

To give you a more in-depth understanding of the gravity of this situation, look at the median household income shortfall in the lower 1/3 of the graphic;

Affordability Testing across Texas: In the lower 1/3 of the graphic look at the median household income shortfall.

This is fraud!

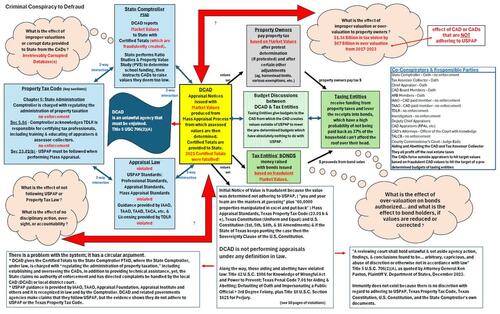

An elaborate scheme (government overreach) of all these entities:

DCAD creates fraudulent income statements, uses comparisons in violation of USPAP, “manipulates 60,000 properties” (audio recording), builds into their valuations the pre-determined budgets of the taxing entities, negotiates values before protest hearings because they can’t get to all the protests, issues a directive to ARB panels not to go below the homestead cap, all of which is a violation of USPAP, Texas Constitution and The Constitution of the United States of America and all of which create dirty data and corrupt databases. Our evidence proves that DCAD and its co-conspirators are not doing appraisals under any definition in law, are violating USPAP, and due to intentionally corrupt databases are incapable of arriving at a legitimate Market Value.

The same mathematical formulas apply across the State of Texas and the United States of America.

There is no other answer other than an elaborate scheme (fraudulent government overreach), and all these entities and people are participating in the scheme.

Overview: Flow of Intertwined organizations and resulting violations of law.

Taxation of unrealized gains (aka Market Value) in violation of the 16th amendment, considering government creep, literally and mathematically means that there would be no probable way for any property owner to make money on their assets in the short term or the long term because of the compound cumulative effect of the overvaluation and over taxation reduces the profit, if any.

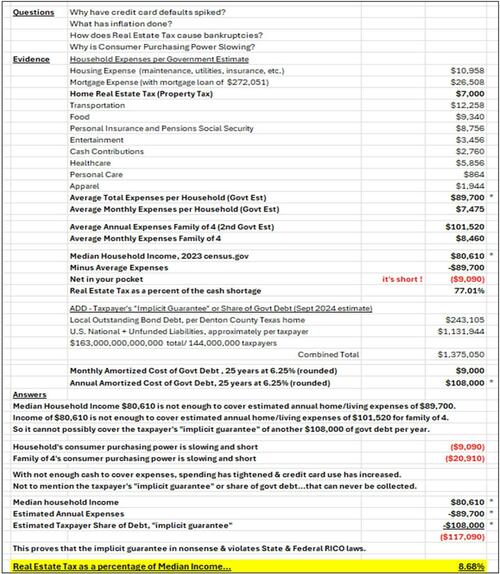

What is lost in the depth of these issues, is that allowing Taxation of Unrealized Gains (Market Value) is cause and the exact definition of bankruptcy where the liabilities are greater than the assets. Further, the home income to debt ratio under the above scenario would breach 60% (Bureau of Labor Statistics, HUD, FHA, and Lenders utilize 28%) and this means that the average Denton County household could not afford a $150,000 home let alone a $350,000 home or as currently claimed by DCAD a $514,000 median value of a home.

16th Amendment to The Constitution of the United States of America – In the years 2016, 2017, 2018, 2019…2023 and prior to the creation of The Constitution of the United States of America, there were and are no laws in the United States that allow Taxation of Unrealized Gains / Market Value. The government overreach as evidenced herein is trying to create Taxation of Unrealized Gains / Market Value, without understanding the ramifications of such action which bring us to where we are…the tipping point. The State of Texas Legislature which created the Taxing Entities which own the CADs and the State Comptroller which allegedly oversees DCAD and the CADs, and the Executive Branch at that time did a work around the U.S. Constitution and have violated the 16th Amendment which states “Congress to lay and collect taxes on incomes, from whatever source derived”. This is why it says, “taxes on incomes”. Then as now, income was understood to refer to gains realized by a taxpayer through payment, exchange, or the like, not merely increase in value of property. Appreciation in the value of a home or other asset is not income until it is sold, and the gain realized, and no property should be taxed on sale or based on market value. We would be remiss if we did not point out that the appreciation in value (inflation) is directly correlated to the decrease in purchasing power of the U.S. dollar which neither DCAD and its co-conspirators take into consideration which ends up being the equity stripping of Mom and Pop.

On average 9% of the median household income goes into real estate tax regardless of home ownership or renting.

Roughly 9% ($7,000.00) of a median income goes to real estate tax on homes. The average household is short roughly $9,000 per year of which $7,000 is real estate tax. The difference of surviving or bankruptcy is the real estate tax.

What is the Wheel of Fraud?

What are the benefits of repealing the real estate tax in favor of a Uniform States Sales Tax?

What are the laws being broken?

If you want the answers and evidence to these questions please see the videos below and related documents below the videos and visit www.mockingbirdproperties.com/dcad All the information is free.

“I sincerely believe…that the principle of spending money to be paid by posterity under the name of funding is but swindling futurity on a large scale”

– Thomas Jefferson 1816

Conclusion

Roughly 9% ($7,000.00) of a median income goes to real estate tax on homes. The average household (37% at risk of losing their home and 65% can’t afford the claimed median home value) is short roughly $9,000 per year of which $7,000 is real estate tax. The difference of surviving or bankruptcy is the real estate tax.

Those who vote against the elimination of real estate tax in favor of a Uniform States Sales Tax are voting against their own family, friends, neighbors, constituents and placing 30% + of the households in bankruptcy.

Title 42 U.S. Code Section 1986, Knowledge of Wrongful Act & Power to Prevent.

Do not make the law irrelevant.

Extraordinary circumstances require extraordinary leadership. Texas can lead in the solution or put its Citizens in imminent harm’s way of bankruptcy. Eliminating a corrupt bankrupt system and prohibiting future financial leverage in the school districts, so that it never happens again is non-negotiable. As there is no alternative, I strongly suggest the immediate elimination of real estate tax in favor of the Uniform States Sales Tax.

Eliminating the real estate tax in favor of the Uniform States Sales Tax, across the U.S., will inject over $1 Trillion back into the economy within 12 months.

* * *

Resources

These are the corresponding videos to this article and the document delivery to President Trump, Elon Musk and Pam Bondi:

Accounting Fraud 60X larger than Enron

Amicus Brief Supporting Property Owners and School Districts and Accounting Fraud.

School Districts Fraud.

Tyler Durden

Thu, 02/27/2025 – 20:55