Today, the rising cost of living is making the American dream increasingly difficult to achieve.

While pandemic-led wage growth boosted real incomes, it followed five decades of stagnant wage increases. At the same time, housing prices have soared. Pushing up prices are a limited supply of homes, with home construction plummeting 55% compared to 2006. Together, these broad economic forces have made it harder to get ahead, even with a competitive salary.

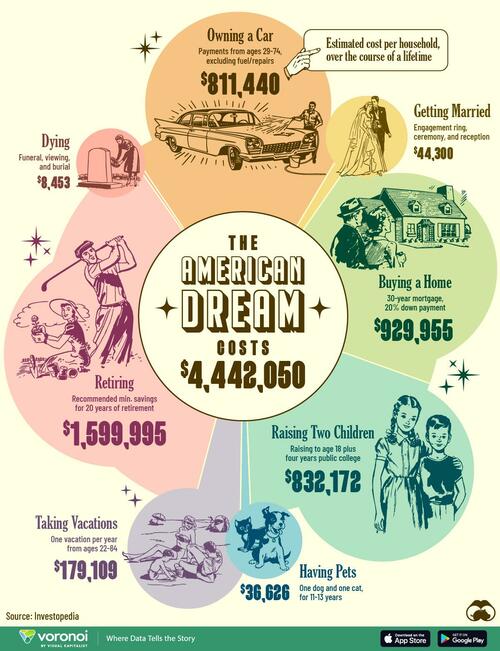

This graphic, via Visual Capitalist’s Dorothy Neufeld, shows the estimated cost of the American dream per household over the course of their lifetime, based on analysis from Investopedia.

The American Dream Costs a Hefty $4.4 Million

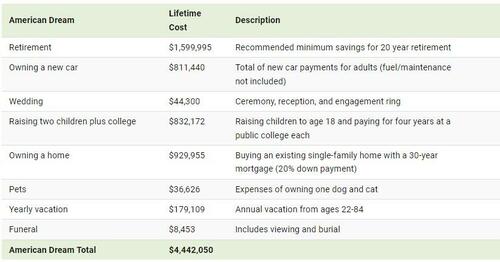

Below, we breakdown each aspect of the American dream by their lifetime cost as of 2024:

The total cost of the American dream is no small sum—$4.4 million—exceeding the average lifetime salaries of both men ($3.3 million) and women ($2.4 million) with a Bachelor’s degree.

Overall, the largest cost is paying for a comfortable retirement. Here, it takes $1.6 million in savings, assuming a 4% annual withdrawal rate and inflation averaging 2.5% per year to retire for 20 years. Notably, the decline in private pension schemes has played a large role in making financial security in later years harder to achieve compared to previous generations.

Unsurprisingly, owning a home was the second-biggest expense, at $930,000 for an existing single-family home. Given the surging cost of home prices, 77% of U.S. households are unable to afford a median-priced home in 2024.

As fertility rates in America hit historic lows, raising two children and sending them to college would cost $832,000 overall. Today, 36% of Americans under 50 who don’t have children cite affordability concerns as a major reason for not having kids. Moreover, average college tuition costs have climbed a remarkable 748% since 1963, after adjusting for inflation.

Following a similar trend, wedding costs, too, have skyrocketed. Between 2019 and 2023, average costs increased by $4,000 alone amid inflationary pressures and pandemic backlogs. Today, it costs over $44,000, including the ceremony, reception, and engagement ring to say “I do”.

To learn more about this topic from a home ownership perspective, check out this graphic on the salary needed to buy a home in 50 U.S. cities.

Tyler Durden

Thu, 10/24/2024 – 23:00