By Vincent Lanci

Summary: This report explores gold’s reemergence not merely as a store of value, but as a strategic monetary tool for circumventing sanctions, supporting trade diplomacy, and conducting debt management. Drawing upon historical precedent, contemporary developments, and theoretical frameworks such as Stephen Miran’s Mar-a-Lago Accord, this essay proposes that the United States is positioned to reengage in a sovereign-level gold trading for purposes of reducing debt, rewarding trade partners, and restoring the US manufacture-export base. This mechanism, once dominated by bullion banks and now emulated by sanctioned states, enables the monetization of gold without outright liquidation. Gold-forward hedges provide the United States with an opportunity to strategically weaken the dollar as a component of its need to remain competitive in export driven global economies, reduce debt obligations, and support trade-partner allies through targeted currency support. This report argues that gold’s transformation under Basel III, coupled with a shift in U.S. monetary strategy, marks a return to gold’s core geopolitical function.

I. Introduction. Gold is a store of value; it is money. With its immutable physical properties, universal recognition, and lack of counterparty risk, gold serves as a uniquely effective asset in sovereign monetary operations. This paper explores how the U.S. can operationalize gold as a monetary instrument to manage debt, influence foreign exchange dynamics, and pursue geopolitical leverage in a deglobalizing world.

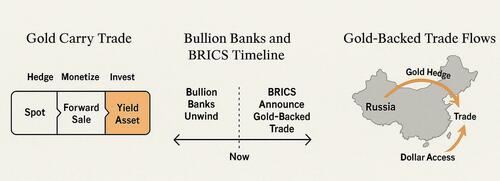

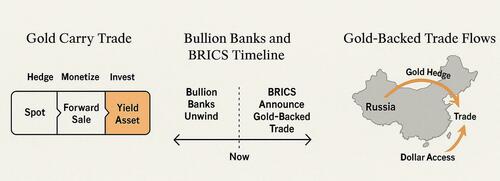

II. Historical Foundation: The Bullion Bank Carry Trade. Beginning in the 1990s, bullion banks employed a gold carry trade model that enabled monetization without sale. This involved:

- Holding physical gold owned or on loan from another party (spot position)

- Selling that gold forward (creating a future potential liability)

- Investing the proceeds in higher-yielding assets (e.g., Treasuries, stocks, or foreign bonds)

This trade structure provided income while keeping physical reserves intact and suppressed upward pressure on gold prices. It became a cornerstone of central bank expectation management strategy and a projection tool of a stable, reliable USD.

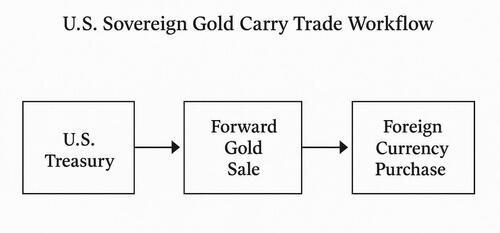

III. The Mar-a-Lago Accord. Stephen Miran’s Mar-a-Lago Accord offered a blueprint for leveraging gold to manage U.S. debt and trade imbalances. That proposal involved:

- Selling U.S. gold reserves

- Using proceeds to purchase foreign currencies with higher yields

- Reducing the effective interest burden on U.S. liabilities

Though politically toxic, the ESF and similar tools had already historically been used in currency stabilization crises. While Miran’s Accord was publicly shelved, some of its core mechanisms remain feasible.

IV. Gold and Sanctions Evasion. The Russia-Iran Model Sanctioned states such as Russia and Iran have leveraged gold to access dollar liquidity via trusted counterparties. By holding and hedging gold through countries like China, they generate liquid proceeds in local or global currencies that are ultimately converted to dollars. This allows them to fund operations while avoiding SWIFT and U.S. financial enforcement.

The oil-for-gold arrangement between Russia and China first described by this paper’s author in 2017. set a precedent. Initially dismissed as rumor, it gained traction when later acknowledged by credible banking analysts. Most recently, an offshoot of its success was announced between China and Saudi Arabia in which the Saudis would receive payment for their oil in RMB with gold optionality attached. The gold would be held by China as it had been for Russian deals. This shows that gold can function as a sanctions-neutral reserve and transfer mechanism while simultaneously being a monetary bridge (mBridge) to the USD or other currencies if needed.

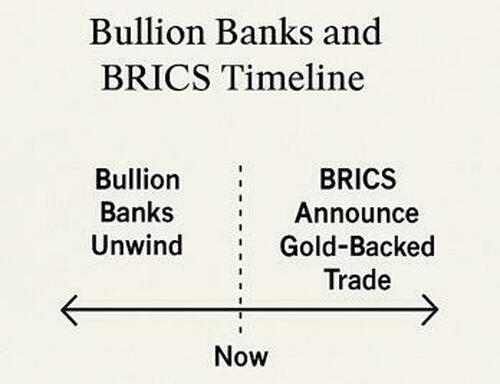

V. Structural Shifts in the Gold Market: The macro and regulatory backdrop has shifted:

- Basel III reclassifies gold as a Tier 1 asset

- Recent OCC Gold derivative reclassification at Banks

- These banks held over 90% of U.S. gold derivative exposure

- BRICS countries now prioritize gold over Treasuries for trade reserves

Together, these changes signal a revaluation of gold within both private and sovereign balance sheets.

VI. A New U.S. Strategy: Gold-Backed Trade Diplomacy. The U.S. can now pursue a sovereign gold carry trade:

- Forward-sale gold to trusted banks

- Use proceeds to buy foreign currencies or EM debt

- Prop up allied currencies, reduce dollar strength

- Execute monetary stimulus while avoiding inflation mismanagement

This framework allows integration of trade and monetary policy. As part of bilateral trade negotiations, the U.S. can offer to stabilize emerging-market currencies, reducing resistance to tariff reform and strengthening political ties.

VII. Conclusion. Gold is returning to center stage as a versatile tool for 21st-century financial statecraft. By adopting carry trade mechanisms pioneered by bullion banks and mirrored by adversarial regimes, the U.S. has the opportunity to align debt management, currency strategy, and trade diplomacy. The convergence of regulatory changes, gold repatriation, and geopolitical fragmentation makes this moment uniquely ripe for gold’s strategic reintegration.

Tyler Durden

Thu, 05/08/2025 – 22:35