What was a miserable shortened week for the USD has gone from bad to worse in early Asia trading, when the Dollar index suddenly collapsed to a fresh 3 year low

While there is no specific catalyst for the suddenly collapse in the illiquid early Asian session, which sees many countries on extended Easter holiday, Bloomberg quotes traders that hedge funds are selling the dollar against virtually any currencies after National Economic Council Director Kevin Hassett said Friday that President Donald Trump is still exploring ways to remove Federal Reserve Chairman Jerome Powell, according to traders.

“The president and his team will continue to study that,” National Economic Council Director Kevin Hassett said Friday when asked by a reporter if removing Powell was an option.

Hassett then suggested, accurately, that the Fed under Powell, who was appointed by Trump during his first term, had acted politically to benefit Democrats.

“The policy of this Federal Reserve was to raise rates the minute President Trump was elected last time, to say that the supply-side tax cuts that were going to be inflationary,” Hassett said, adding that Fed officials opted not to go “on TV and at IMF meetings and warn about the terrible inflation from the obvious runaway spending from Joe Biden, and the obvious runaway spending from Joe Biden was textbook inflationary,” Hassett continued. “And then they cut rates right ahead of the election.”

Hassett, is of course, correct, as we first pointed out two weeks ago…

Fed reaction function pic.twitter.com/80AzJlZo3h

— zerohedge (@zerohedge) April 9, 2025

… as Bank of America’s Michael Hartnett pointed out on Friday…

Fed cut 50bps in Sept when stock market at record high, Atlanta Fed was forecasting +3% US GDP growth; Fed now determined not to cut rates after 20% market plunge, Atlanta Fed forecasting -3% GDP growth

… and as former NY Fed president Bill Dudley made crystal clear all the way back in 2019.

The day is August 27, 2019. Former NY Fed president Bill Dudley writes a Bloomberg oped saying “the Fed shouldn’t enable Donald Trump” and urged the central bank not to “provide offsetting stimulus” in Trump’s trade war with China.

Six years later, here we are pic.twitter.com/H6WT5O0cMD

— zerohedge (@zerohedge) April 11, 2025

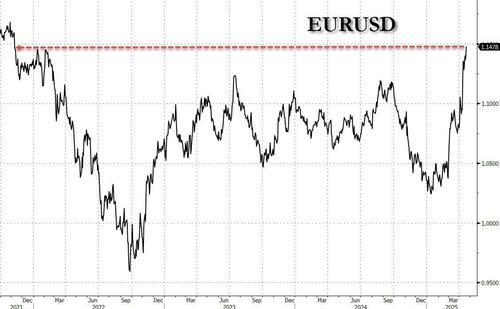

But since the market is terrified of the truth, especially if it means that Trump could take monetary policy actions into his own hands, the result has been a wholesale liquidation of all main currency pairs, with the EUR jumping to 3 year highs, even though Europe’s economy remains an unmitigated disaster (Germany’s upcoming debt spending spree notwithstanding), and even though the surge in the euro will make Europe’s modest recession into a brutal one..

… the Yen surging 11% from its January lows, and at just over 141, the highest it has been against the dollar since the summer of 2023…

… and, of course, gold which is storming to new record highs this evening, spiking above $3,373, its dip last week now a distant memory.

Yet none of these moves are surprising to anyone who read – as we repeatedly urged – the Miran Mar-A-Lago paper: yes, the plunge in the dollar is just what the admin quietly wants (they have repeatedly stated they want a strong dollar “in the long term”, but certainly not in the short, when the collapse in the greenback will boost US exports).

Ironically, if Powell will not cut rates to ease financial conditions, Trump’s repeated browbeating of the Fed chair and threats to fire him will crash the dollar low enough to where Trump will get his financial easing one way or another.

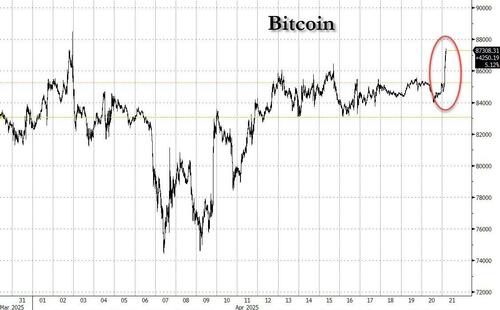

Still, there was one notable outlier in tonight’s Dollar selloff: bitcoin. While previously any plunge in the dollar (and by extension surge in the yen) would batter what was little is left of the carry trade, hammering tech stocks and cryptos, tonight we finally saw a regime shift, and after flatlining initially, a burst of buying pushed bitcoin almost $2000 higher, above $87000, and its biggest one day move since Liberation Day…

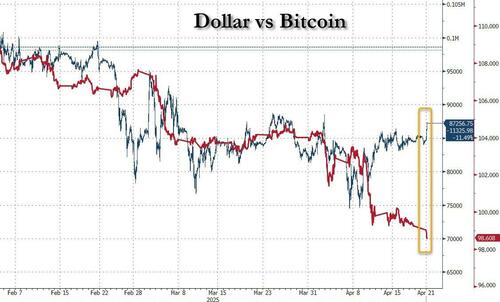

… and the result is that while bitcoin had generally tracked the DXY Dollar index lower for much of 2025, the last few weeks – and certainly Sunday night – have seen a very tangible snap in this relationship.

This breach in the right correlation between the two, suggests that with gold approaching ridiculous prices, the next flight to safety away from the collapsing dollar will be bitcoin – after all, it’s only a matter of time before all other central banks unleash a money printing frenzy to hammer their own currencies.

And since all bitcoin needs is a little unexpected upside to spark a huge short squeeze and to get the momentum trades piling on, should today’s phase reversal sustain for a few days, we may see new all time highs in bitcoin in a very short time.

But wait… because the real fun for non-fiat assets will start once other central banks – such as the BOJ and ECB – can no longer just sit and watch as the dollar disintegrates, pushing their own currencies into the stratosphere and killing their economies… and they retaliate by restarting the next round of global fiat debasement first by slashing rates and then by restarting the money printer.

Tyler Durden

Sun, 04/20/2025 – 21:54